‘Shrinkflation’ isn’t a trend – it’s a permanent hit to your wallet – BBC

|

Getting your Trinity Audio player ready...

|

SOURCE: Alexis Benveniste | BBC

Products are getting smaller, and you’re paying the same. The problem won’t go away, even if the economy rebounds and inflation abates.

If you’ve noticed you’re getting less while your bill at the till stays the same, it’s not just you.

‘Shrinkflation’ – reducing a product’s size or quantity while keeping its price stable – is rampant. As the global economy grapples with issues including rising raw material costs, supply chain backlogs and higher post-pandemic labourer wages, consumers are bearing the brunt of spiking production expenses.

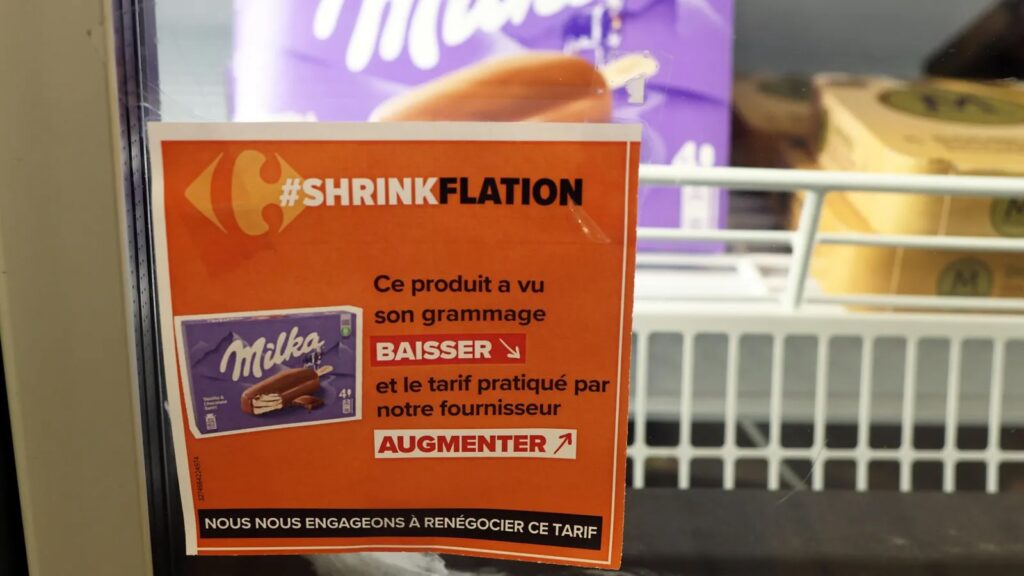

Whether it’s toilet roll or a bag of crisps, the practice, which mostly happens during times of inflation, is showing up in shops around the world. Last week, French supermarket Carrefour put stickers on products to warn consumers when a packet’s contents have gotten smaller without a corresponding price decrease.

Consumers are taking note of the shift to smaller packaging – and, naturally, they aren’t happy, especially as their purchasing power is already falling amid inflation. Yet as uncomfortable as the sticker shock is now, a longer-term problem looms large: past manifestations of the phenomenon show the story of shrinkflation doesn’t end when inflation does.

In terms of consumer frustrations, “they notice price increases more than they notice size decreases”, says US-based Mark Stiving, the chief pricing educator at Impact Pricing, an organisation that educates companies on pricing. As a result, he says, companies use shrinkflation to raise prices “less painfully”.

Cammy Crolic, an associate professor at University of Oxford’s Saïd Business School, who focuses on consumer behaviour, agrees. Because consumers are so focused on how their purchases are affecting their wallets, she says, they are “more likely to notice the increase in price than the amount of product ‘lost’ when packages shrink”.

Consumers do not always see the changes right away; often, they are incremental. For instance, a favourite drink that may have come in a 12oz (340g) bottle a year earlier may now be offered for the same price, yet downsized to 10oz (283g) now.

And experts say that once the new sizes are on the shelf, they are likely to stay that way. Phil Lempert, food industry analyst and editor of SupermarketGuru adds that, since shoppers don’t have a choice, they have to adapt to the changes.

In some cases, they can switch to products with better value – US-based Lempert says brand loyalty plummets amid shrinkflation, with people often transitioning to house brands. But with essentials, consumers may not have as much choice. For instance, if you depend on baby formula, and a store only stocks one option, you’re stuck paying the price on the sticker, and getting whatever is in the tin; at Carrefour, Nestlé’s Guigoz infant milk formula had gone from a pack size of 900g to 830g (31.7oz to 29oz), for example.

Yet even as shrinkflation largely corresponds with inflation, Crolic says consumers usually don’t see product sizes rebound even after economic challenges abate. There are rare exceptions, but companies generally seize the opportunity to use less product and make the same amount – or more.

Instead, a new phenomenon often takes hold. “After products are repeatedly reduced in size, the manufacturer will come out with a new, larger version of it – sometimes with a fanciful new name,” agrees Edgar Dworsky, a former US consumer rights lawyer and founder of resource guide Consumer World. And with it, shoppers pay a higher cost for the upgrade.

Potato crisps, for example, have continued to downsize amid shrinkflation, says Dworsky. In past instances, snack company Lay’s, a division of PepsiCo, responded to this change by ultimately re-releasing its large bag size, but with a new name – “Party Size” – that they could sell at a higher price.

Dworsky also points to toilet roll, which he says has been shrinking for decades. He explains that when the rolls started to get small enough that consumers noticed, manufacturers began introducing larger sizes back to the market again. As bigger packages made their way onto shelves, companies including Charmin shifted their marketing, naming them “double”, “triple” and even “mega” rolls. (And now, amid this period of shrinkflation, even Charmin’s Ultra Soft “super mega” rolls are getting smaller).

Whether grocers use stickers to warn shoppers or not, it’s a tough pill to swallow – and a tough hit to the bottom line – especially because the price of products generally doesn’t fall as inflation does. Consumers may need to continue to be highly budget conscious as they shop, and make sure they don’t fall into the trap of that Ultra Mega Super-Duper size on the shelf.

This article was originally published on BBC. You can view the original article here.