Amazon nibbles away at Google’s search advertising dollars – AdAge

|

Getting your Trinity Audio player ready...

|

SOURCE: Garett Sloane | AdAge

Brand spending on Amazon is growing because the advertising opportunity is growing.

“Brand spending on Amazon is growing because the advertising opportunity is growing,” says Kerry Curran, managing partner of marketing integration at Catalyst, a search and social media marketing firm.

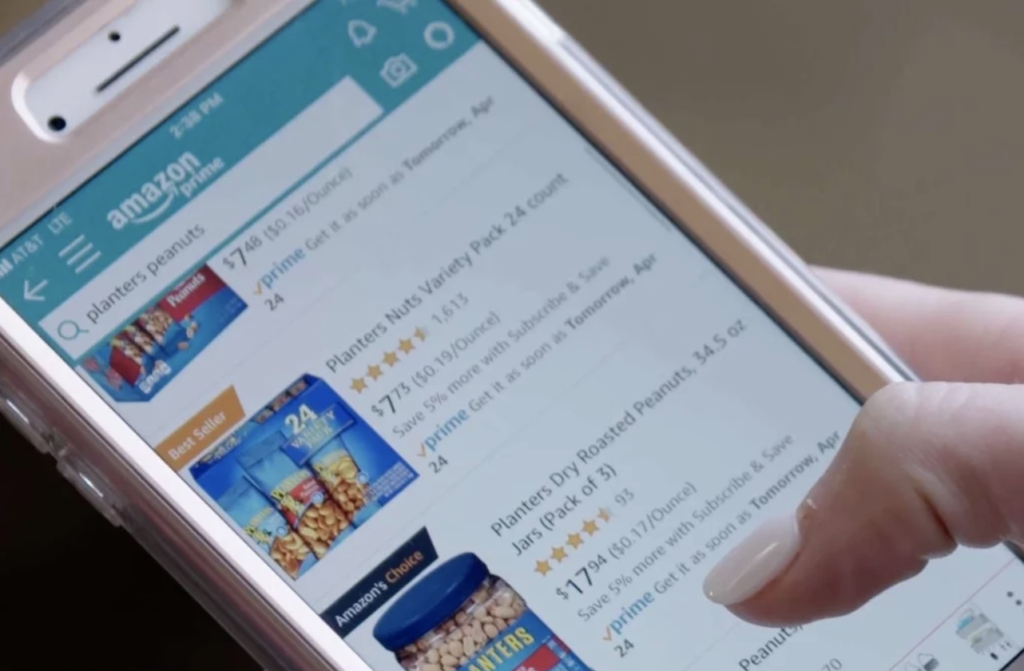

Over the past two years, Amazon has developed its automated ad platform so it can work more closely with Madison Avenue to funnel brands into its marketplace. Advertisers have found the best way to compete on Amazon, and even to compete against the e-commerce company, is to pay to promote their products on its sites. Brands can buy sponsored product ads that give them higher visibility when people search the site.

Consumer behavior is changing, as well, with more product searches starting on Amazon, eating into Google’s territory, Curran says. “What we’ve seen is an increase in more of those broader search terms, too,” Curran says. “People who don’t know exactly what they want are going to Amazon. They know they want something and can search things like ‘buy a gift.’”

People who don’t know exactly what they want are going to Amazon. They know they want something and can search things like ‘buy a gift’.

Google and Amazon could both benefit from the perception of competition. The tech behemoths are both in the crosshairs of regulators at the Department of Justice and Federal Trade Commission, which are looking into allegations of anti-competitive practices at a number of Silicon Valley companies. Google’s search stranglehold has always been a source of antitrust concerns. Meanwhile, Amazon has been criticized for using its e-commerce marketplace to promote its own in-house brands over rivals.

Brands accustomed to working with the legacy stores and supermarkets are starting to adjust their marketing strategies to account for the rise of digital retail, according to Shafique Niazi, associate director of Amazon and marketplace marketing at Rise Interactive, a search agency. The money that brands used to put into marketing in stores to make their products stand out on the shelf is now going to online promotions.

“What was an offline team is now an online team,” Niazi says. “That’s a big change.”